Welcome to the ultimate, ever-relevant Bitcoin guide. Bitcoin’s story is one of digital rebellion, economic innovation, and a dash of mystery. From its enigmatic origins to its current status as a global financial asset, Bitcoin has challenged the status quo and forced the world to rethink what money can be. This guide will take you on a journey through Bitcoin’s history, technology, economics, and future, while also providing a blueprint for further exploration and content development.

Table of contents

What is Bitcoin? The basics

Bitcoin is a decentralised digital currency-think of it as internet money that no single government, bank, or company controls. It allows peer-to-peer transactions without intermediaries, using a public ledger called the blockchain to record every move. Unlike fiat currencies, Bitcoin is scarce (only 21 million will ever exist), programmable, and borderless.

Key features

- Decentralisation: No central authority; network run by thousands of computers (nodes).

- Scarcity: Hard cap of 21 million coins.

- Transparency: Every transaction is public, but users remain pseudonymous.

- Immutability: Once data is written to the blockchain, it’s (practically) unchangeable.

The genesis of Bitcoin: From concept to reality

Bitcoin emerged from the ashes of the 2008 global financial crisis, representing a radical solution to age-old problems in traditional banking and currency systems. The story begins not with the launch of Bitcoin itself, but with decades of cryptographic innovation that paved the way for this revolutionary technology.

Digital currency precursors

Long before Bitcoin captured the world’s imagination, cryptographers, and computer scientists were exploring the concept of digital money. In 1996, the National Security Agency, a U.S. intelligence agency, published a whitepaper titled “How To Make A Mint: The Cryptography of Anonymous Electronic Cash,” foreshadowing many concepts that would later appear in Bitcoin. Notable early attempts at digital currencies included Wei Dai’s b-money and Nick Szabo’s bit gold, both of which conceptualized solutions to creating scarce digital assets.

Adam Back’s development of Hashcash in 1997 introduced proof-of-work as a means to control spam, establishing a fundamental concept that would become crucial to Bitcoin’s functionality. Meanwhile, Hal Finney developed reusable proof of work (RPOW), further refining these ideas. These predecessors, while not entirely successful on their own, collectively laid the groundwork for what would become the world’s first viable cryptocurrency.

The origin story: Satoshi Nakamoto and the Genesis Block

On October 31, 2008, a mysterious figure using the pseudonym “Satoshi Nakamoto” published a nine-page whitepaper titled “Bitcoin: A Peer-to-Peer Electronic Cash System” on a cryptography mailing list. This document outlined a groundbreaking solution to the long-standing double-spending problem that had plagued previous digital currency attempts. The whitepaper described a system that could facilitate electronic transactions without relying on trust in a central authority-a truly revolutionary concept.

The true identity of Satoshi Nakamoto remains one of the greatest mysteries in the technology world. Despite numerous investigations and claims, no conclusive evidence has emerged to identify who Nakamoto really was-whether an individual programmer or a collaborative group working under a single pseudonym. This anonymity has become part of Bitcoin’s mystique and aligns with its ethos of decentralization.

The first block and early days

On January 3, 2009, Bitcoin came into existence when Satoshi Nakamoto mined the Genesis Block: block number zero on the Bitcoin blockchain. Embedded in this first block was the text: “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks,” referencing a headline from The Times newspaper. This wasn’t just a timestamp; it was a pointed commentary on the traditional banking system that Bitcoin was designed to challenge.

BITCOIN GENESIS BLOCK

Raw Hex Version

Satoshi Nakamoto message embedded in the coinbase of the first block

00000000 01 00 00 00 00 00 00 00 00 00 00 00 00 00 00 00 ................

00000010 00 00 00 00 00 00 00 00 00 00 00 00 00 00 00 00 ................

00000020 00 00 00 00 3B A3 ED FD 7A 7B 12 B2 7A C7 2C 3E ....;£íýz{.²zÇ,>

00000030 67 76 8F 61 7F C8 1B C3 88 8A 51 32 3A 9F B8 AA gv.a.È.ÈŠQ2:Ÿ¸ª

00000040 4B 1E 5E 4A 29 AB 5F 49 FF FF 00 1D 1D AC 2B 7C K.^J)«_Iÿÿ...¬+|

00000050 01 01 00 00 00 01 00 00 00 00 00 00 00 00 00 00 ................

00000060 00 00 00 00 00 00 00 00 00 00 00 00 00 00 00 00 ................

00000070 00 00 00 00 00 00 FF FF FF FF 4D 04 FF FF 00 1D ......ÿÿÿÿM.ÿÿ..

00000080 01 04 45 54 68 65 20 54 69 6D 65 73 20 30 33 2F ..EThe Times 03/

00000090 4A 61 6E 2F 32 30 30 39 20 43 68 61 6E 63 65 6C Jan/2009 Chancel

000000A0 6C 6F 72 20 6F 6E 20 62 72 69 6E 6B 20 6F 66 20 lor on brink of

000000B0 73 65 63 6F 6E 64 20 62 61 69 6C 6F 75 74 20 66 second bailout f

000000C0 6F 72 20 62 61 6E 6B 73 FF FF FF FF 01 00 F2 05 or banksÿÿÿÿ..ò.

000000D0 2A 01 00 00 00 43 41 04 67 8A FD B0 FE 55 48 27 *....CA.gŠý°þUH'

000000E0 19 67 F1 A6 71 30 B7 10 5C D6 A8 28 E0 39 09 A6 .gñ¦q0·.\Ö¨(à9.¦

000000F0 79 62 E0 EA 1F 61 DE B6 49 F6 BC 3F 4C EF 38 C4 ybàê.aÞ¶Iö¼?Lï8Ä

00000100 F3 55 04 E5 1E C1 12 DE 5C 38 4D F7 BA 0B 8D 57 óU.å.Á.Þ\8M÷º..W

00000110 8A 4C 70 2B 6B F1 1D 5F AC 00 00 00 00 ŠLp+kñ._¬....In the early months of 2009, Bitcoin operated as an experiment among cryptographers and technology enthusiasts. The first-ever Bitcoin transaction occurred when Satoshi sent 10 BTC to computer scientist Hal Finney, who had been an early contributor to the project. These initial adopters mined Bitcoin on standard personal computers, as the computing power required was relatively modest compared to today’s standards.

Establishing real-world value

For nearly two years, Bitcoin had no established monetary value in the traditional sense. Then came a watershed moment: on May 22, 2010, a programmer named Laszlo Hanyecz made the first commercial transaction using Bitcoin, purchasing two pizzas for 10,000 BTC. At today’s values, this would be worth hundreds of millions of pounds, earning this date the permanent moniker “Bitcoin Pizza Day” in cryptocurrency lore.

This transaction represented the first time Bitcoin was assigned a tangible value in exchange for physical goods. By late 2010, Bitcoin began trading on rudimentary exchanges, with the price jumping from $0.10 to $0.20 on October 26, 2010. This marked the beginning of Bitcoin’s journey as not just a technological innovation, but as a tradable asset with monetary value.

How does Bitcoin work? Blockchain, mining, and security

Understanding Bitcoin requires grasping the revolutionary technology that powers it. While often described simply as “digital money,” the technical innovations beneath Bitcoin’s surface represent one of the most significant breakthroughs in computer science and economic theory of the 21st century.

The blockchain

At its core, Bitcoin operates on a blockchain-a distributed ledger that maintains a continuous record of all transactions across a network of computers. Unlike traditional banking ledgers maintained by a central authority, Bitcoin’s blockchain is maintained collectively by thousands of computers worldwide.

Each “block” contains a batch of transactions, cryptographically linked to the previous block, forming a “chain” that extends back to the genesis block. This structure creates an immutable record that cannot be altered without the consensus of the network, providing transparency and security without requiring trust in any central entity.

Mining and Proof of Work

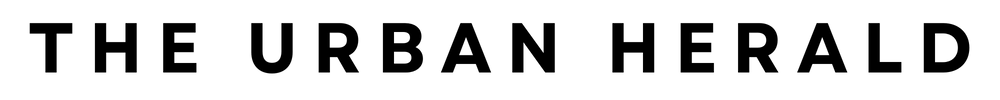

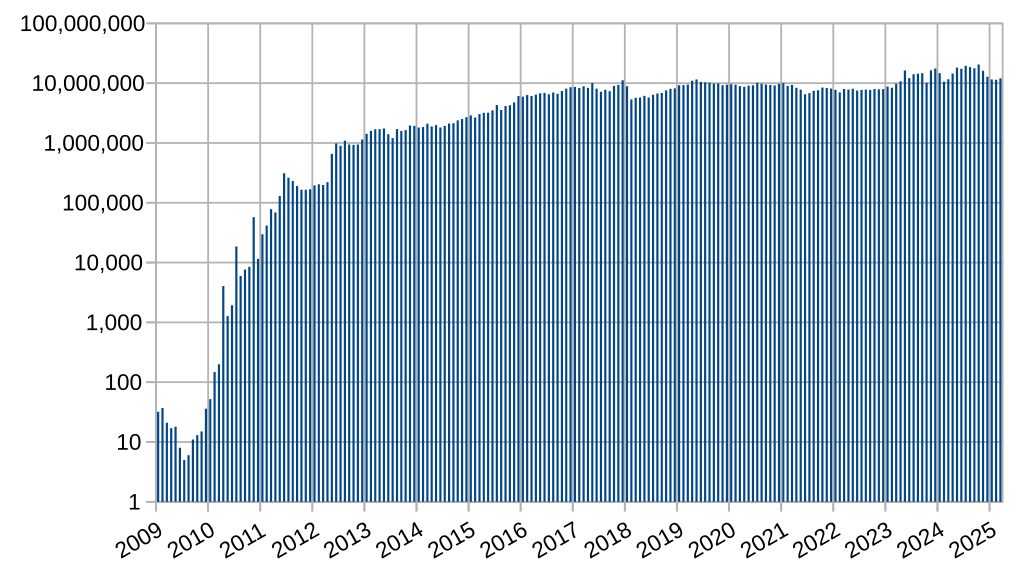

Bitcoin mining is the process by which new bitcoins are created and transactions are added to the blockchain. Miners use powerful computers to solve complex mathematical problems based on a cryptographic hash algorithm called SHA-256. This process serves two crucial functions: it secures the network against attacks and provides a mechanism for reaching consensus about the state of the blockchain without central coordination.

The mining process works through “proof-of-work,” where miners compete to find a specific value (called a “nonce”) that, when added to the block data and processed through the hash function, produces a result that meets certain criteria. This process is intentionally difficult and resource-intensive, requiring significant computational power. The first miner to find a valid solution announces it to the network, adds the new block to the blockchain, and is rewarded with newly created bitcoins plus transaction fees.

This system:

- Ensures network security via computational effort.

- Aligns incentives: miners are rewarded for honest behaviour.

- Adjusts difficulty every 2016 blocks (~2 weeks) to maintain a 10-minute block time.

Bitcoin’s supply cap and halving mechanism

One of Bitcoin’s most revolutionary economic features is its predetermined supply cap: only 21 million bitcoins will ever be created. This stands in stark contrast to fiat currencies, which can be printed at will by central banks, potentially leading to inflation.

The rate at which new bitcoins are created is governed by the “halving” mechanism, where the mining reward is cut in half approximately every four years (or every 210,000 blocks). When Bitcoin launched, miners received 50 bitcoins per block. The first halving occurred in 2012, reducing the reward to 25 bitcoins. Subsequent halvings in 2016 and 2020 reduced the reward to 12.5 and then 6.25 bitcoins respectively. The most recent halving in 2024 brought the reward down to 3.125 bitcoins per block.

This diminishing supply issuance creates a stock-to-flow ratio that increases over time, theoretically enhancing Bitcoin’s scarcity and potentially its value. The final bitcoin is expected to be mined around the year 2140.

Security through cryptography

Bitcoin’s security model relies heavily on public-key cryptography. Users control their bitcoins through digital “wallets” that contain cryptographic keys. The public key generates a Bitcoin address where others can send funds, while the private key authorizes the spending of those funds. This asymmetric cryptography ensures that only the rightful owner can spend their bitcoins, while anyone can verify the legitimacy of transactions on the public blockchain.

Economic sustainability

Miners’ revenue comes from two sources: new bitcoins (block subsidy) and transaction fees. Over time, as halvings reduce block rewards, transaction fees are expected to play a larger role. The network’s security depends on mining remaining profitable-hence the ongoing debate about long-term sustainability.

Decentralisation and competition

Despite fears of centralisation, Bitcoin mining remains highly competitive and geographically dispersed. However, mining pools (groups of miners sharing rewards) do concentrate some power, with the top three pools controlling over 60% of hashrate as of 2023.

The economic engine: Miners, incentives, and sustainability

Bitcoin’s economic model is a masterclass in game theory. Every participant-miner, user, developer-acts in their own self-interest, yet the system incentivises cooperation and honest validation.

- Perfect Competition: The mining industry resembles a textbook example, with low profit margins and constant pressure to innovate or perish.

- Barriers to Entry: While anyone can mine, industrial-scale operations dominate due to hardware and energy costs.

- Hashrate and Security: The higher the network’s hashrate, the more secure it is against attacks.

- Halving Events: Every four years, the block reward halves, reducing new supply and often triggering price surges (and existential angst among miners).

Bitcoin’s market evolution

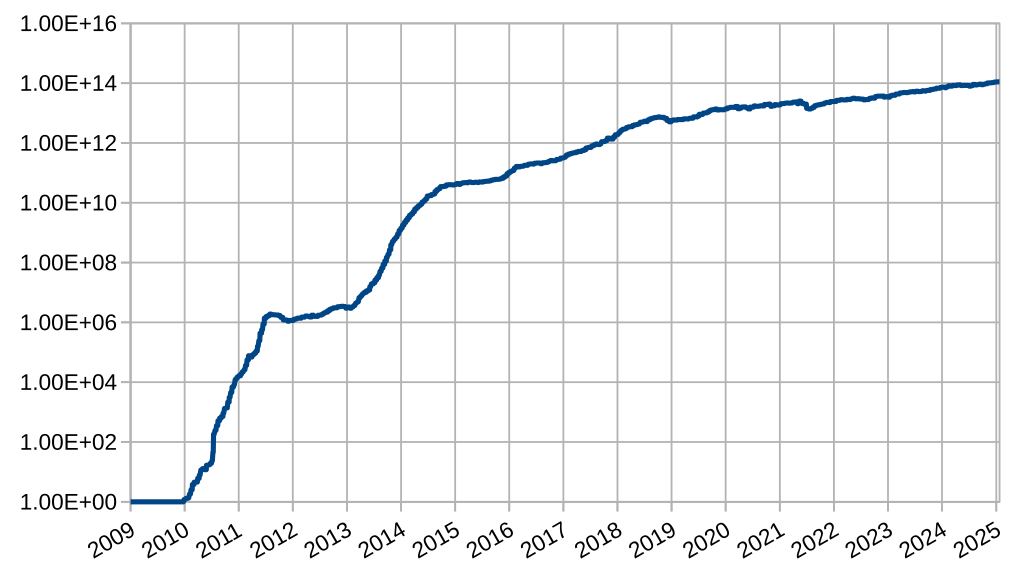

Bitcoin’s journey from an obscure digital token worth pennies to a global financial asset worth tens of thousands of pounds represents one of the most remarkable market evolutions in financial history. This section traces Bitcoin’s price history and the key market phases that have defined its development.

The early years: 2009-2013

Bitcoin had zero monetary value when it was first introduced in 2009. For the first year and a half of its existence, it was primarily a curiosity among cryptographers rather than an investment asset. The first significant price milestone came in October 2010, when Bitcoin’s value increased from below $0.10 to $0.20 for the first time.

In 2011, Bitcoin experienced its first major price surge, reaching $1 in February and eventually peaking at $29.60 in June-a remarkable 30,000% increase from its starting point just months earlier. This was followed by a sharp correction, demonstrating what would become a recurring pattern of volatility in Bitcoin’s price history.

Expansion and recognition: 2013-2017

The period from 2013 to 2017 saw Bitcoin gaining wider recognition and experiencing significant price growth. By early 2013, Bitcoin had regained its previous high and began attracting more mainstream attention. This was the era when Bitcoin expanded beyond the realm of technology enthusiasts and began to attract early investors.

Multiple exchanges emerged during this period, making it easier for people to buy and sell Bitcoin. However, this growth wasn’t without setbacks-the collapse of Mt. Gox, once the largest Bitcoin exchange, in 2014 represented a significant crisis of confidence in the ecosystem. Despite this, crucial technological innovation continued to progress thanks to Bitcoin’s decentralised nature. New technologies such as the Lightning Network and multi-signature wallets were developed to enhance Bitcoin’s security and flexibility.

Mainstream breakthrough: 2017-2018

Bitcoin’s value reached a milestone in 2017, climbing to approximately $20,000 by December. This dramatic rise was driven by increasing interest from traditional investors and significantly elevated Bitcoin’s profile in mainstream media, establishing its status as a legitimate asset class.

Governments worldwide began to recognise Bitcoin’s significance, and regulatory scrutiny increased as authorities attempted to manage the rapidly growing crypto economy. During this period, technological debates within the Bitcoin community led to the creation of Bitcoin Cash in August 2017, which was designed to address Bitcoin’s scaling challenges.

However, 2018 brought a severe market correction, with Bitcoin’s price falling by more than 80% from its peak. This “crypto winter” reminded investors of the asset’s volatility and the importance of sustainable growth.

Institutional adoption: 2020-2023

After the coronavirus pandemic disrupted global markets in March 2020, Bitcoin experienced a remarkable recovery. The May 2020 halving event reduced the new supply of bitcoins, and by late 2020, the asset had surged past its previous all-time high.

A key development during this period was the entrance of institutional investors and publicly traded companies into the Bitcoin market. MicroStrategy, Square (now Block), and Tesla made significant Bitcoin purchases for their corporate treasuries, lending new legitimacy to Bitcoin as a store of value.

In 2021, Bitcoin reached new heights, exceeding $60,000 before experiencing another significant correction. The broader adoption continued with El Salvador becoming the first country to adopt Bitcoin as legal tender in September 2021.

Recent milestones: 2024-2025

The years 2024 and 2025 have marked significant milestones in Bitcoin’s market evolution. In January 2024, after years of regulatory battles, the U.S. Securities and Exchange Commission finally approved spot Bitcoin ETFs, creating a bridge between traditional finance and cryptocurrency and further legitimising Bitcoin as a credible investment.

Bitcoin achieved a remarkable milestone when it surpassed $80,000 for the first time on Sunday, 10 November 2024. This bull run continued, with Bitcoin reaching an unprecedented high of over $100,000 on 4 December 2024. This surge was influenced by the U.S. presidential election results and a more crypto-friendly political stance, demonstrating how Bitcoin’s value has become increasingly connected to macroeconomic and political factors.

However, despite these price achievements, the Google Trends index for ‘Bitcoin’ hit its lowest level in 2025, suggesting a potential shift in public interest despite the price performance. Analyst Axel Adler Jr. noted that since the start of 2025, the Google Trends index has remained within the 30-100 range for Bitcoin, with support fluctuating around 30. This divergence between price performance and public interest represents an interesting development in Bitcoin’s market evolution.

Bitcoin’s price history: From pennies to powerhouse

Bitcoin’s price journey is legendary. In 2010, 10,000 BTC bought two pizzas (now worth hundreds of millions). By late 2021, Bitcoin neared $70,000, before enduring wild swings.

- 2013: First major bubble and crash, peaking at $1,100.

- 2017: Mania drives price to $20,000, followed by a brutal bear market.

- 2021: Institutional adoption, pandemic stimulus, and inflation fears push BTC to new highs.

- 2024-2025: Spot Bitcoin ETFs, another halving, and renewed interest see BTC break $100,000 before a sharp correction and recovery.

The economic impact of Bitcoin

Bitcoin’s influence extends far beyond its price movements and technological innovations. As the first successful cryptocurrency, it has initiated profound changes in economic thinking, financial systems, and even geopolitics. This section examines the broader economic impact of Bitcoin since its inception.

Challenging monetary policy

Perhaps Bitcoin’s most significant economic contribution has been challenging conventional monetary policy. As a currency with a fixed supply cap of 21 million, Bitcoin stands in stark contrast to fiat currencies that can be created at will by central banks. This has sparked global conversations about inflation, currency debasement, and the nature of money itself.

During periods of expansionary monetary policy, such as the quantitative easing programs implemented after the 2008 financial crisis and the COVID-19 pandemic, Bitcoin has emerged as an alternative monetary system that operates outside the control of central banks. This has resonated particularly strongly in countries experiencing high inflation or currency controls.

Bitcoin as digital gold

Bitcoin’s programmed scarcity has led many economists and investors to view it as “digital gold”-a store of value rather than primarily a medium of exchange. Like gold, Bitcoin is divisible, portable, durable, and scarce, but with the additional benefits of being easily transferable across borders and impossible to counterfeit.

This “digital gold” narrative gained substantial traction during the inflationary environment of 2020-2023, when institutional investors began allocating portions of their portfolios to Bitcoin as a hedge against inflation and currency devaluation. This shift in perception from a speculative asset to a legitimate store of value represents one of the most significant developments in Bitcoin’s economic impact.

Disrupting cross-border payments

Traditional international money transfers are often slow, expensive, and subject to numerous intermediaries. Bitcoin’s borderless nature has demonstrated the potential for more efficient cross-border value transfer. This has particular relevance for remittances-money sent by migrant workers to their home countries-which traditionally suffer from high fees and slow processing times.

In countries with substantial diaspora populations like the Philippines, Mexico, and Nigeria, Bitcoin and other cryptocurrencies have begun to make inroads as alternative remittance channels. This development has put pressure on traditional money transfer operators to improve their services and lower their fees.

Banking the unbanked

Approximately 1.4 billion adults worldwide remain unbanked, lacking access to basic financial services. Bitcoin’s permissionless nature-requiring only an internet connection and a digital wallet-has created new possibilities for financial inclusion in regions with limited banking infrastructure.

In countries across Africa and Southeast Asia, Bitcoin and cryptocurrency adoption has grown rapidly, offering alternatives to unreliable local currencies and providing access to financial services previously unavailable to many citizens. Mobile-based Bitcoin services have enabled individuals to store value, make payments, and participate in the global economy without traditional banking relationships.

Spurring central bank innovation

Bitcoin’s rise has prompted central banks worldwide to accelerate research and development into Central Bank Digital Currencies (CBDCs). As of 2025, dozens of countries are in various stages of CBDC development or implementation, representing one of the most significant shifts in monetary systems in decades.

This “defensive innovation” demonstrates how Bitcoin has forced established financial institutions to evolve, even as they seek to maintain control over monetary systems. The competition between decentralised cryptocurrencies like Bitcoin and state-issued CBDCs represents a fascinating economic experiment that continues to unfold.

Bitcoin adoption and use cases

Bitcoin’s journey from a niche technological experiment to a globally recognised asset has been marked by expanding adoption across various sectors. This section explores the diverse ways Bitcoin is being used in 2025 and the milestones in its adoption journey.

Merchants and Payment Processors

The acceptance of Bitcoin as a payment method has grown substantially since the early days when a few tech-savvy businesses experimented with cryptocurrency transactions. Major companies including Microsoft, PayPal, and Dell began accepting cryptocurrencies as early as 2014.

By 2025, the retail adoption landscape has evolved significantly. Major e-commerce platforms offer Bitcoin payment options, while point-of-sale systems in physical stores increasingly accommodate cryptocurrency transactions. Payment processors have developed sophisticated solutions that allow merchants to accept Bitcoin while receiving settlement in their local currency, eliminating volatility concerns for businesses.

The Lightning Network, a “layer 2” solution built on top of Bitcoin’s main blockchain, has dramatically improved Bitcoin’s viability for everyday transactions by enabling near-instant, low-fee payments. This technological advancement has been crucial in expanding Bitcoin’s use as an actual medium of exchange rather than solely as a store of value.

Financial products and services

The approval of spot Bitcoin ETFs in January 2024 marked a watershed moment in Bitcoin’s integration with traditional finance. These investment vehicles allow exposure to Bitcoin’s price movements without the complexity of directly holding the asset, making cryptocurrency investment accessible to a broader range of investors and institutions.

Beyond ETFs, the financial services ecosystem around Bitcoin has expanded to include:

- Bitcoin-backed loans and yield-generating products

- Bitcoin futures and options trading on regulated exchanges

- Bitcoin-focused retirement accounts

- Bitcoin custody solutions for institutional investors

- Bitcoin insurance products

This proliferation of financial products has created multiple pathways for different types of investors to gain Bitcoin exposure according to their risk tolerance and regulatory requirements.

Corporate treasury adoption

The trend of publicly traded companies adding Bitcoin to their balance sheets gained momentum after MicroStrategy’s initial $250 million purchase in August 2020. By 2025, this practice has evolved from a novelty to a recognised treasury strategy for companies seeking to diversify cash reserves and hedge against inflation.

The companies adopting this approach span various sectors, from technology firms to insurance companies and industrial manufacturers. Corporate Bitcoin holdings now represent a significant percentage of the circulating supply, effectively removing these coins from active trading and potentially contributing to Bitcoin’s scarcity value.

Nation-state adoption

El Salvador’s adoption of Bitcoin as legal tender in September 2021 represented the first instance of a sovereign nation embracing cryptocurrency at the governmental level. While this move was initially met with skepticism from international financial institutions, El Salvador’s experiment has yielded interesting results and sparked similar considerations in other nations.

By 2025, several other countries with dollarised economies or challenges with their domestic currencies have implemented various levels of Bitcoin integration into their financial systems. This trend has been particularly notable in regions with high remittance flows, unstable local currencies, or limited access to traditional banking services.

Self-sovereign finance

Perhaps the most revolutionary use case for Bitcoin remains its original purpose: enabling individuals to control their own financial assets without intermediaries. This “self-sovereign finance” approach has particular relevance in regions with unstable banking systems, high inflation, or currency controls.

The ability to store value in a censorship-resistant asset that can be accessed anywhere with an internet connection has proven valuable during periods of financial instability. This fundamental use case continues to drive adoption in regions with economic or political uncertainty, reinforcing Bitcoin’s role as a financial safety net for individuals facing systemic challenges.

The regulatory landscape

The regulatory environment surrounding Bitcoin has evolved dramatically since its inception. From being largely ignored by authorities in its early years to becoming the subject of intense regulatory scrutiny and increasingly sophisticated frameworks, Bitcoin’s relationship with regulators reflects its journey from fringe technology to mainstream financial asset.

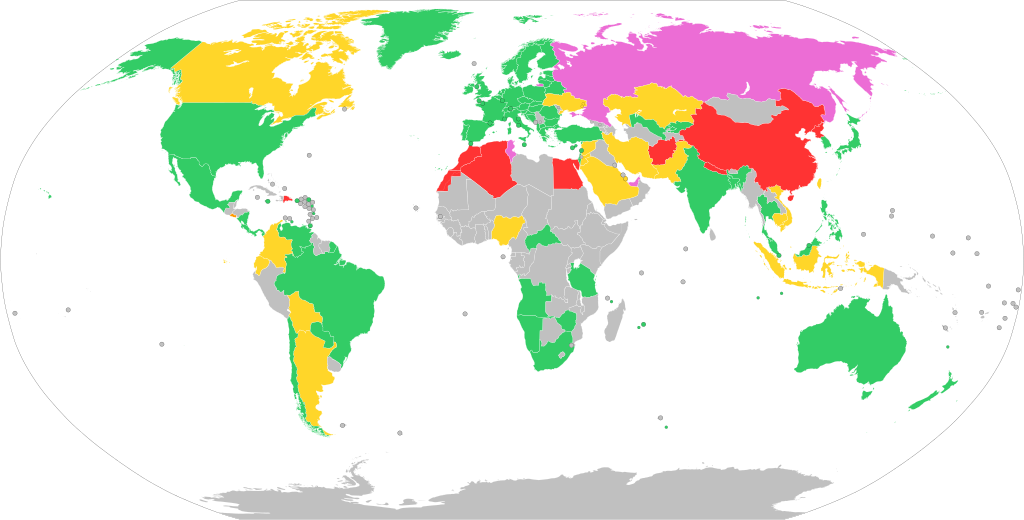

Global regulatory evolution

Regulatory approaches to Bitcoin have varied widely across jurisdictions, creating a patchwork of frameworks that continues to evolve. Early regulatory concerns primarily focused on potential illicit use and consumer protection. As Bitcoin gained mainstream adoption, regulatory attention shifted toward financial stability, tax compliance, and integrating cryptocurrencies into existing financial frameworks.

By 2025, most major economies have established specific regulatory frameworks for cryptocurrencies, though with varying degrees of restrictiveness. Some jurisdictions have embraced Bitcoin with progressive regulations designed to attract cryptocurrency businesses, while others have imposed significant restrictions or outright bans.

Key regulatory developments through 2025

Several milestone regulatory developments have shaped Bitcoin’s legal status and adoption trajectory:

- The approval of Bitcoin ETFs in the United States in January 2024 represented a significant legitimisation of Bitcoin within the traditional financial system. This decision followed years of applications and rejections, reflecting the gradual shift in regulatory perspectives as the market matured.

- The European Union’s Markets in Crypto-Assets (MiCA) regulation, fully implemented by 2024, established one of the most comprehensive cryptocurrency frameworks globally. This regulation provided clarity for businesses operating across the EU while imposing consumer protection and stability requirements.

- In Asia, regulatory approaches have ranged from Japan’s progressive licensing system for cryptocurrency exchanges to China’s restrictions on cryptocurrency trading and mining. These divergent approaches have influenced regional Bitcoin adoption patterns and contributed to shifts in the geographic distribution of mining operations.

Compliance requirements

Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements have become standard for regulated cryptocurrency businesses worldwide. These compliance measures, once resisted by some in the cryptocurrency community as contradicting Bitcoin’s pseudonymous design, are now widely accepted as necessary for mainstream adoption.

For individual Bitcoin users, the compliance landscape has also evolved. Self-hosted wallets-where users maintain control of their private keys-remain available but face increasing scrutiny in some jurisdictions. Meanwhile, services that facilitate compliance with tax reporting and other regulatory requirements have proliferated, making it easier for users to remain compliant while using Bitcoin.

Tax treatment

The taxation of Bitcoin has become more standardised as tax authorities worldwide have developed specific guidance. In most jurisdictions, Bitcoin is treated as property for tax purposes, with capital gains tax applying to appreciation in value. Some countries have introduced specific provisions for cryptocurrency taxation, including reporting requirements for exchanges and other service providers.

Tax compliance software for cryptocurrency users has evolved significantly, making it easier to track transactions and calculate tax obligations-a necessary development given the complexity of applying traditional tax concepts to cryptocurrency activities.

Central bank perspectives

Central banks have shifted from dismissing Bitcoin as a curiosity or potential threat to actively engaging with cryptocurrency innovation. Many central banks now maintain dedicated teams monitoring cryptocurrency developments and exploring their implications for monetary policy and financial stability.

The development of Central Bank Digital Currencies (CBDCs) represents one response to the challenge posed by Bitcoin and other cryptocurrencies. By 2025, several major economies have launched or are piloting CBDCs, creating a new dynamic between state-issued digital currencies and decentralised alternatives like Bitcoin.

The future of Bitcoin

As Bitcoin approaches its third decade of existence, its future trajectory remains a subject of intense speculation and debate. This section explores the potential developments and challenges that may shape Bitcoin’s evolution in the coming years.

Technological evolution

Bitcoin’s base layer protocol has intentionally evolved slowly, prioritising security and stability over rapid feature development. This conservative approach to core protocol changes is likely to continue, maintaining Bitcoin’s fundamental characteristics while allowing innovation to occur on secondary layers.

The Lightning Network, Bitcoin’s primary scaling solution, has seen significant adoption improvements since 2021. This second-layer protocol enables fast, low-cost transactions without compromising the security of the main blockchain. As Lightning Network infrastructure and user interfaces continue to improve, Bitcoin’s utility for everyday payments is likely to expand.

Other technical innovations in the pipeline include developments like Taproot upgrades, which improve privacy and smart contract capabilities, and potential improvements to mining efficiency and decentralisation. These technical developments aim to enhance Bitcoin’s functionality while preserving its core value proposition.

Supply dynamics and future halvings

Bitcoin’s programmed supply schedule will continue to unfold through future halving events, with the next halving expected in 2028. Each halving reduces the rate of new Bitcoin creation, increasing the stock-to-flow ratio and potentially impacting price dynamics through reduced selling pressure from miners.

By 2025, approximately 94% of all bitcoins that will ever exist have been mined. As the mining reward continues to diminish with future halvings, transaction fees are expected to constitute an increasing portion of miner revenue, potentially changing the economics of mining and network security.

The final bitcoin is projected to be mined around the year 2140, though long before this date, the mining reward will become negligibly small. How the Bitcoin network’s security model will evolve as block rewards approach zero remains an open question that the community continues to debate.

Institutional integration

The integration of Bitcoin into traditional financial systems is likely to continue accelerating. Following the approval of spot Bitcoin ETFs in 2024, other financial products and services built around Bitcoin are expected to proliferate, creating multiple avenues for institutional exposure.

Corporate adoption of Bitcoin for treasury management may expand beyond early adopters, potentially becoming a standard practice for a portion of corporate reserves. This trend could be particularly pronounced if inflationary pressures persist in major economies.

Financial institutions are increasingly likely to offer Bitcoin-related services to their clients, from custody solutions to trading platforms and wealth management advice. This mainstreaming of Bitcoin services could substantially expand access to cryptocurrency for retail investors who prefer to interact through familiar financial institutions.

Geopolitical considerations

Bitcoin’s role in the geopolitical landscape may evolve as nations reassess monetary sovereignty in the digital age. The adoption of Bitcoin as a reserve asset by sovereign wealth funds or central banks, while still speculative, has been increasingly discussed as a possibility for nations seeking alternatives to dollar dominance.

Countries experiencing currency instability or facing international sanctions may continue to explore Bitcoin as an alternative financial infrastructure. This trend could accelerate if geopolitical tensions increase or if confidence in traditional reserve currencies wanes.

The competition between private cryptocurrencies like Bitcoin and state-issued Central Bank Digital Currencies will likely intensify, potentially creating a multi-tiered monetary ecosystem where different forms of digital money serve different purposes.

Long-term price projections

Predicting Bitcoin’s price remains notoriously difficult due to its unique combination of monetary, technological, and social factors. Various valuation models have been proposed, from stock-to-flow ratios to network adoption metrics, each offering different perspectives on Bitcoin’s potential value.

Conservative projections based on Bitcoin’s increasing adoption as a store of value suggest continued growth over long time horizons, albeit with significant volatility along the way. More aggressive models point to potential valuations in the hundreds of thousands or even millions of pounds per bitcoin if it achieves status as a global monetary asset.

The 2024 milestone of exceeding $100,000 represents a significant psychological threshold crossed. Whether this level becomes a new foundation for future growth or merely another peak in Bitcoin’s volatile history remains to be seen.

Challenges and criticisms

Despite Bitcoin’s remarkable growth and increasingly mainstream acceptance, it continues to face significant challenges and criticisms. Understanding these concerns is essential for a complete perspective on Bitcoin’s position and prospects.

Energy consumption debates

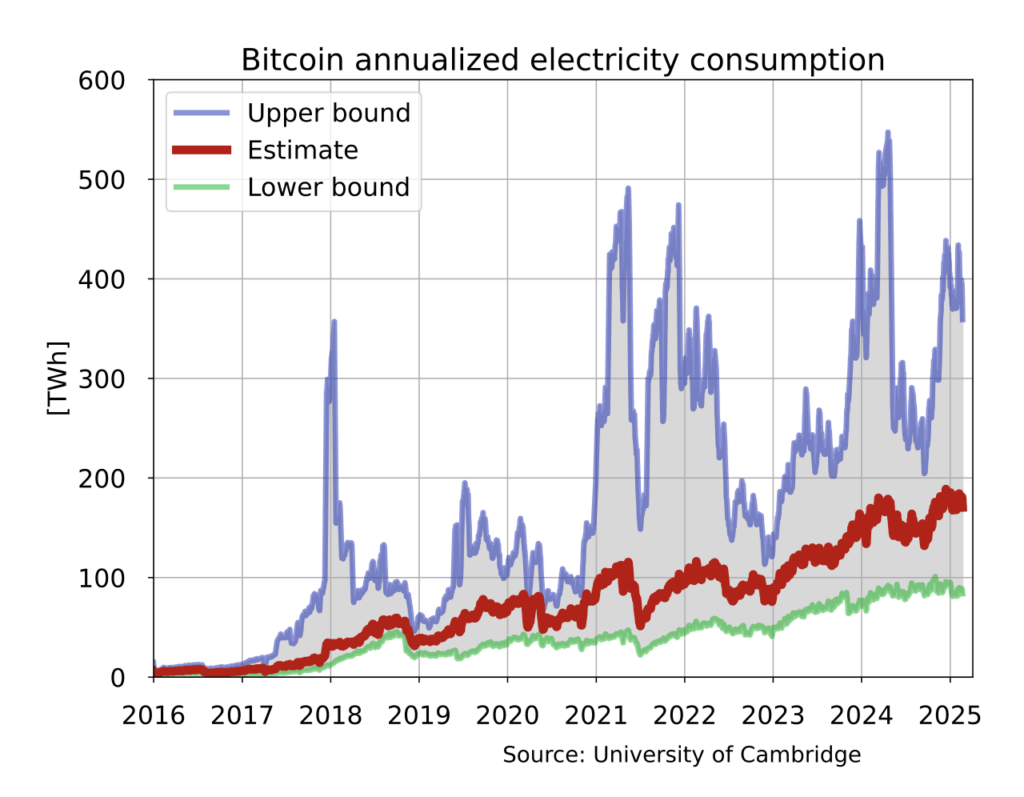

Perhaps the most prominent criticism of Bitcoin relates to its energy consumption. The proof-of-work consensus mechanism requires substantial computational power, which translates to electricity usage. Critics argue that this energy consumption is excessive and environmentally damaging, especially in a world increasingly concerned with climate change.

Proponents counter with several arguments: that Bitcoin increasingly utilises renewable energy sources, that its energy usage should be compared to the traditional financial system’s total footprint, and that Bitcoin mining can incentivise renewable energy development by providing flexible demand for otherwise curtailed energy production.

The debate around Bitcoin’s environmental impact has evolved from simplistic criticisms to more nuanced discussions about energy sources, carbon intensity, and the value proposition that justifies energy expenditure. This conversation is likely to continue as both Bitcoin mining and renewable energy technologies evolve.

Volatility concerns

Bitcoin’s price volatility, while diminished compared to its early years, remains significantly higher than traditional financial assets. This volatility presents challenges for Bitcoin’s adoption as a medium of exchange and unit of account-two traditional functions of money.

For merchants accepting Bitcoin payments, volatility risk can be mitigated through immediate conversion to fiat currencies. For individuals using Bitcoin as a store of value, the volatility represents both risk and opportunity, depending on time horizons and risk tolerance.

As Bitcoin markets mature and institutional participation increases, some analysts expect volatility to gradually decrease. However, Bitcoin’s fixed supply and the speculative component of its value suggest that some degree of price volatility may remain an inherent characteristic.

Security considerations

While Bitcoin’s core protocol has proven remarkably resilient, with no successful attacks on the fundamental blockchain, security risks exist primarily at the points where users interact with the Bitcoin ecosystem.

Exchange hacks, phishing attacks, and user errors in managing private keys have resulted in significant Bitcoin losses over the years. The technical complexity of securely managing cryptocurrency continues to present a barrier to mainstream adoption, though user interfaces and security best practices have improved substantially.

The concentration of mining power, while not at levels considered immediately threatening to network security, remains a theoretical vulnerability. The geographic distribution of mining operations has diversified following China’s 2021 crackdown on cryptocurrency mining, potentially improving decentralisation but raising new considerations about regulatory risks in other jurisdictions.

Scalability limitations

Bitcoin’s base layer processes approximately 7 transactions per second-far fewer than would be required for global payment processing. While the Lightning Network and other second-layer solutions address this limitation for many use cases, scaling Bitcoin to accommodate global adoption remains a technical challenge.

The tension between maintaining decentralisation and improving transaction throughput continues to shape Bitcoin’s technical development. The community’s general preference for preserving Bitcoin’s decentralised nature and security over maximising transaction capacity reflects the prioritisation of Bitcoin’s role as sound money rather than a universal payment system.

Regulatory uncertainties

Despite increasing regulatory clarity in many jurisdictions, Bitcoin still faces regulatory uncertainties that could impact its adoption and development. These include potential restrictions on private cryptocurrency usage as central banks develop their own digital currencies, enhanced compliance requirements that could compromise privacy, and the possibility of coordinated international regulations that restrict Bitcoin’s permissionless nature.

The regulatory landscape continues to evolve, with outcomes ranging from embracing Bitcoin as a legitimate financial innovation to imposing significant restrictions that could limit its utility in certain jurisdictions.

Final thoughts

Will Bitcoin become the digital gold of the 21st century, a global reserve asset, or fade into irrelevance? The answer depends on:

- Continued technological innovation.

- Regulatory clarity and global coordination.

- Market acceptance and integration into financial infrastructure.

- The network’s ability to transition from block rewards to transaction fees for miner incentives.

If history is any guide, Bitcoin will continue to surprise both its fiercest critics and most ardent supporters. As the world’s first truly decentralised, borderless, and programmable money, its story is far from over.

Bitcoin is not just a technology or an investment-it’s a social, economic, and philosophical movement. It challenges our assumptions about money, power, and trust. Whether it becomes the backbone of a new financial order or the greatest bubble in history, one thing is certain: Bitcoin is here to stay, and its story is still being written.

So, are you ready to be part of the next chapter?