Imagine a world where Bill Gates, the iconic co-founder of Microsoft, never parted with a single share of his company and kept every cent for himself. According to recent calculations by Forbes, this alternate universe would crown Gates as the world’s first trillionaire, with a jaw-dropping net worth of $1.2 trillion—leaving even the likes of Elon Musk and Jeff Bezos in the financial dust. But how does this fantasy stack up against reality, and what does it say about the choices that shape both personal fortunes and the world at large? Let’s unpack the numbers, the history, and the implications of Gates’s hypothetical trillion-dollar empire.

The foundation: Microsoft’s early days and IPO

Before Microsoft became a global behemoth, it was a scrappy start-up founded in 1975 by Bill Gates and Paul Allen in Albuquerque, New Mexico. The company’s big break came in 1980, when it licensed its MS-DOS operating system to IBM, setting the stage for the PC revolution. Fast forward to March 13, 1986: Microsoft goes public in what many dubbed “the IPO of the year,” with shares priced at $21 each. At the time, Gates owned an astonishing 49% of Microsoft—about 11.2 million shares—making his stake worth roughly $200 million on day one.

For context, Microsoft’s IPO valued the company at $777 million (that’s about $2.14 billion in today’s money). Gates’s immense stake set the stage for what could have been the greatest personal fortune in history. The IPO also marked the beginning of a new era in technology, with Microsoft’s software soon becoming the backbone of personal and business computing worldwide.

Microsoft’s meteoric stock growth

If you’ve ever glanced at a long-term Microsoft stock chart, you know it’s been a wild, upward ride. Over nearly four decades, Microsoft has transformed from a software upstart into a $3.4 trillion tech titan. The company’s share price has ballooned, especially in the last decade, thanks to the rise of cloud computing, AI, and relentless innovation. Microsoft’s dominance in operating systems, productivity software, and now cloud infrastructure has made it a staple of global business and a darling of Wall Street.

Key factors in this exponential growth:

- Stock splits: Microsoft has split its stock nine times since its IPO, dramatically increasing the number of shares an original investor would hold. Gates’s original 11.2 million shares would have multiplied to about 3.2 billion shares today.

- Dividends: Microsoft began paying regular dividends in 2003, adding a steady stream of cash to loyal shareholders. Forbes estimates Gates would have collected around $100 billion in after-tax dividends alone if he’d held tight.

- Compound growth: The magic of compounding means that holding onto a high-growth stock like Microsoft for decades can turn millions into billions—and, in this hypothetical, billions into trillions. The company’s average annual returns have outpaced the broader market, especially as digital transformation accelerated in the 2010s and 2020s.

Microsoft’s resilience is also worth noting. The company weathered the dot-com bust, the 2008 financial crisis, and fierce competition from Apple, Google, and Amazon. Under Satya Nadella’s leadership, Microsoft’s pivot to cloud services with Azure and its embrace of AI have only turbocharged its valuation.

The “no selling shares” scenario

So, what if Gates had never sold a single share? According to Forbes, he and Melinda French Gates would now own 3.2 billion Microsoft shares, representing a 43% stake in the company—worth about $1.4 trillion at current valuations. Add in that $100 billion in dividends, and you’re looking at a personal fortune that’s not just staggering, but historic.

Why do most billionaires sell shares? The answer is simple: diversification and liquidity. Concentrating all your wealth in one company, even one you founded, is risky. Gates, following the advice of investment legends like Warren Buffett, chose to diversify his assets over time, investing in everything from waste management to agriculture to luxury hotels. This strategy shields against market volatility and the unpredictable winds of the tech sector. Gates’s family office, Cascade Investment, is a masterclass in risk management, with holdings in Republic Services, Deere & Co, and Four Seasons Hotels and Resorts.

But in our alternate reality, Gates resists this temptation, keeping every Microsoft share—and every dollar they generate—under his control. The result? A single individual with a financial stake in the world’s most valuable software company that rivals the GDP of entire countries.

The “no philanthropy” scenario

Now, let’s add another twist: no philanthropy. In reality, Bill and Melinda French Gates have donated over $60 billion to the Bill & Melinda Gates Foundation since 2000, making them the second-largest philanthropists in the US. The Foundation itself has distributed more than $100 billion in grants, transforming global health, education, and poverty initiatives. In 2020 alone, the Foundation spent $5.8 billion, dwarfing the annual giving of any other private foundation.

The scale of Gates’s giving is almost without peer. The Foundation has played a pivotal role in eradicating diseases like poliomyelitis, fighting malaria and HIV/AIDS, and improving access to vaccines and education in the world’s poorest regions. In the US, its grants have shaped public education policy and advanced research into everything from clean energy to pandemic preparedness.

In our hypothetical, every cent that went to charity instead stays in Gates’s personal coffers. That means not only does he retain all his Microsoft wealth, but he also never parts with the tens of billions that have gone to fight disease, improve education, and tackle poverty. The Gateses’ combined fortune, in this reality, would be an unprecedented $1.5 trillion.

The $1.2 trillion calculation (based on Forbes)

Let’s put the numbers together:

- Microsoft shares: 3.2 billion shares x recent share price ≈ $1.4 trillion.

- Dividends (after tax): ≈ $100 billion.

- No donations: Retain all funds given to charity (over $60 billion to the Gates Foundation alone).

Forbes’s methodology combines the value of these retained shares and accumulated dividends, minus taxes and splits, to arrive at the $1.2 trillion figure for Gates’s personal fortune. Melinda French Gates, in this scenario, would also be worth around $300 billion, making her the third-richest person on the planet.

To put the scale in perspective: the cash from dividends alone would eclipse the entire net worth of most billionaires, and the stake in Microsoft would give Gates outsized influence over the direction of the world’s most important tech company.

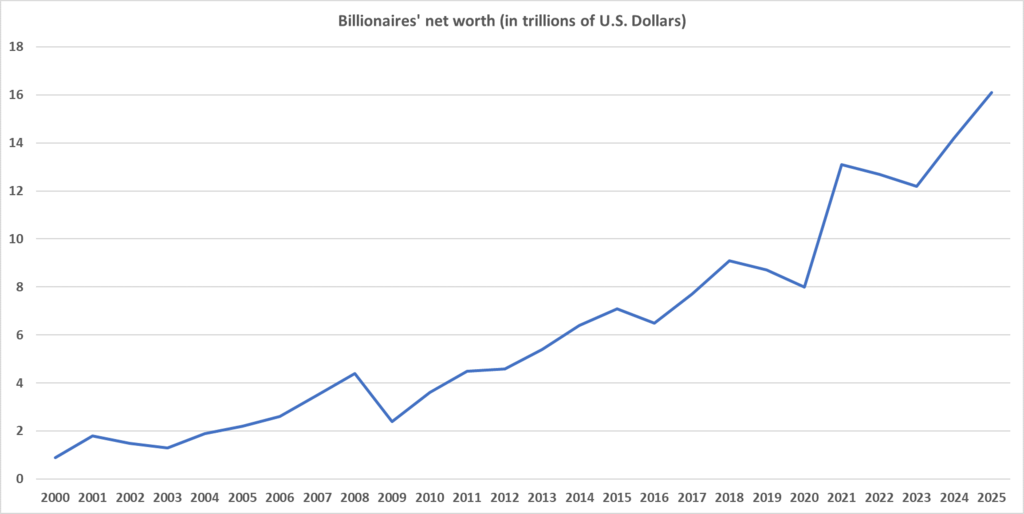

Context: becoming the world’s first trillionaire

How does this stack up against today’s billionaire leaderboard? Elon Musk, the current wealth champion, peaked at $464 billion in late 2024 before dropping back to around $330–$380 billion in 2025. Jeff Bezos’s net worth topped out at $228 billion, while Bernard Arnault, the luxury goods mogul, sits at $173 billion. In other words, Gates’s hypothetical $1.2 trillion would be more than triple Musk’s best and several times the fortune of any other billionaire in history.

| Name | Peak Net Worth (USD) | Main Source |

|---|---|---|

| Bill Gates (hypothetical) | $1.2 trillion | Microsoft (never sold or donated) |

| Elon Musk | $464 billion | Tesla, SpaceX |

| Jeff Bezos | $228 billion | Amazon |

| Bernard Arnault | $173 billion | LVMH |

Being the world’s first trillionaire isn’t just a headline—it’s a seismic shift in the concentration of wealth. Gates’s fortune would rival the GDP of major nations, and his financial influence would be unmatched in modern history. For comparison, the GDP of the Netherlands is about $1 trillion; Indonesia, the world’s fourth most populous country, has a GDP of $1.4 trillion. Gates, in this scenario, could theoretically buy entire countries—or at least their annual output.

It’s also worth noting that the combined hypothetical Gates fortune ($1.5 trillion) would make Bill and Melinda the richest couple in contemporary history, far outpacing even the legendary fortunes of the Rockefellers or Carnegies when adjusted for inflation.

Why the reality is different

Of course, reality tells a more nuanced story. Gates began selling Microsoft shares in the late 1990s, both to diversify his portfolio and to fund his philanthropic ambitions. His investment office, Cascade Investment, has since spread his wealth across a broad range of industries, insulating him from the ups and downs of the tech sector. This is classic risk management: don’t put all your eggs in one basket, even if that basket is called Microsoft.

Philanthropy, too, has been central to Gates’s legacy. He and Melinda French Gates co-founded the Giving Pledge with Warren Buffett, encouraging other billionaires to commit at least half their wealth to charitable causes. Gates has repeatedly stated he does not want to die rich, and has pledged to give away “virtually all” of his fortune by 2045. The impact of their giving is hard to overstate: from eradicating diseases to improving education, the Gates Foundation has changed millions of lives worldwide.

Gates’s latest pledge is to donate 99% of his remaining wealth, with the Foundation set to close in 2045, distributing an additional $200 billion over the next two decades. This giving outpaces even the legendary industrialists of the past, and only Warren Buffett’s philanthropic commitment may rival it in scale.

Gates’s actual investment strategy is also instructive for aspiring billionaires. His portfolio today is a masterclass in defensive, diversified investing: blue-chip dividend stocks, infrastructure, consumer staples, and a healthy dose of tech—but with no single bet as large as his original Microsoft stake. His approach is about stability, capital preservation, and social impact, not just raw accumulation.

What could such wealth mean?

Let’s indulge the hypothetical for a moment: what would it mean for one person to command $1.2 trillion? Gates would wield more economic power than many governments. With that kind of capital, he could:

- Buy every team in the Premier League, La Liga, and Serie A—and still have change for a moon base.

- Single-handedly fund the annual budgets of several major UN agencies for decades.

- Outbid entire nations for influence in tech, healthcare, and global policy.

- Dictate the direction of global AI development, renewable energy, or even space exploration, simply by writing a cheque.

- Influence elections, markets, and even the course of international diplomacy with philanthropic or investment decisions.

But with such power comes scrutiny, risk, and, arguably, a moral burden. Would Gates have become the world’s most influential private citizen—or simply the world’s richest? Would his outsized stake in Microsoft have sparked antitrust alarms, or would regulators have forced a breakup decades ago? The social, political, and economic ramifications of such concentrated wealth are almost impossible to fathom.

And yet, the reality is that Gates chose a different path. His decision to give away his fortune, rather than hoard it, has arguably had a greater impact on the world than any single business deal or investment ever could.

Conclusion

So, could Bill Gates have been the world’s first trillionaire if he’d never sold a Microsoft share or given away a cent? Absolutely—Forbes’s $1.2 trillion estimate isn’t just plausible, it’s a testament to the compounding power of innovation and patience. But the real story is about choices: Gates chose to diversify, to give, and to shape a legacy that extends far beyond personal wealth.

In the end, Gates’s fortune could have been astronomically larger. But perhaps his true legacy isn’t in what he could have kept, but in what he chose to give away. The world may never see a trillionaire quite like the hypothetical Gates, but it has certainly benefited from the real one.

What would you do with $1.2 trillion? And, more importantly, what would you give up to get it? Let us know in the comments below—because sometimes, the richest legacy isn’t measured in dollars at all.